The economic team, led by Finance Secretary Benjamin E. Diokno, held the seventh Philippine Economic Briefing (PEB) in Singapore on June 15, 2023 at the Fullerton Hotel to showcase the country’s robust growth and new investment opportunities.

“We will harness private capital and expertise through the public-private partnership mechanism. This will be critical in upgrading our health, energy, logistics, agriculture, transportation, telecommunications, digital connectivity, and water infrastructure––key sectors identified in the recently published Infrastructure Flagship Projects list approved by the NEDA Board,” Secretary Diokno said in his keynote message.

The PEB in Singapore was jointly organized by the BSP’s Investor Relations Group (BSP-IRG), Department of Finance (DOF), DBS Bank, and the Investment & Capital Corporation of the Philippines (ICCP).

It was attended by around 110 foreign investors from business and financial communities, including business chambers and the media.

“Beyond question, Singapore holds a special place in the Philippines’ growth story. This year, we celebrate 54 years of diplomatic relations, an enduring partnership characterized by strong political, economic, cultural, and people-to-people ties,” Secretary Diokno said.

Singapore is the Philippines’ top source of foreign direct investment (FDI) inflows, with investments in key sectors including renewable energy (RE), infrastructure, healthcare, manufacturing, and information and communications technology (ICT). It is also the Philippines’ seventh largest trading partner globally, fifth largest export market, and sixth largest import supplier.

The economic team held its first economic briefing in Singapore last September 9, 2022. Since then, the Philippine economy has witnessed positive developments, growing by a robust 7.6 percent in 2022 and 6.4 percent in the first quarter of 2023, outpacing emerging Asian economies including India, Malaysia, Indonesia, China, Vietnam, and Thailand.

The expansion was broad-based across the three major production sectors, led by Services (8.4 percent), then Industry (3.9 percent) and Agriculture (2.2 percent).

BSP Deputy Governor Francisco G. Dakila, Jr. who presented the Philippine Outlook for 2023 to 2024 said that the Philippine economy was driven largely by pent-up demand or “revenge spending”, as evidenced by increases in hotel and restaurant spending in the first quarter (24 percent) and car sales (30 percent).

Due to this robust performance, the International Monetary Fund (IMF) and World Bank (WB) revised their growth projections upward to 6.0 percent for the Philippines.

Furthermore, the Philippines has maintained investor-grade credit ratings and improved its outlook from Negative to Stable as seen in the recently released Fitch Ratings report.

“All of these give us confidence that we are on track to achieving our 2023 growth target of 6.0 percent to 7.0 percent, and a faster 6.5 to 8.0 percent from 2024 to 2028,” Secretary Diokno said.

As the country’s headline inflation continued to slow down for four consecutive months to 6.1 percent in May 2023, Secretary Dioko assured investors that the Philippine government will manage inflation by deploying appropriate monetary and fiscal measures to achieve price stability.

The BSP’s baseline inflation forecast was revised to 5.5 percent from 6.0 percent during the Monetary Board meeting last May 18, 2023. Meanwhile, the outlook for 2024 was also revised to 2.8 percent, from the 2.9 percent last March.

“Evidently, the Philippine economy is endowed with stable macroeconomic fundamentals, grounded on fiscal prudence, agile risk management, and groundbreaking structural reforms,” Secretary Diokno said.

Apart from the amendments to the Retail Trade Liberalization Act, Foreign Investments Act, and Public Service Act, Secretary Diokno also shared that the Philippines has opened up its RE sector to full foreign ownership in solar, wind, hydro, and tidal energy.

Another landmark reform is the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act which provides for a flexible and generous incentives system that is performance-based, targeted, time-bound, and transparent.

“Since the enactment of CREATE up to end-May 2023, the Fiscal Incentives Review Board [FIRB] approved the grant of incentives to thirty-nine projects, representing 693.6 billion pesos or about 12.4 billion US dollars in investment capital. These are expected to create more than 28,000 jobs,” said Secretary Diokno, who also chairs the FIRB.

The Finance Secretary also emphasized the need for greater cooperation among economies in the region, citing the IMF’s growth projection of 5.3 percent for Emerging and Developing Asia for 2023 – faster than other regions.

According to Secretary Diokno, the Philippines’ participation in the Regional Comprehensive Economic Partnership (RCEP) Agreement will further promote regional cooperation in a time of geoeconomic fragmentation.

“We are eager to reap the benefits of expanded trade, increased export coverage, and deeper economic integration among RCEP members,” Secretary Diokno said.

For the first time since its approval by Congress on May 31, 2023, Secretary Diokno shared details on the Maharlika Investment Fund (MIF), which he said will be an important addition to the country’s existing funding mechanisms, with the aim of promoting socio-economic development through investments in strategic, high-return, high-impact sectors, including infrastructure.

In his welcome remarks, DBS Group Chief Executive Officer Piyush Gupta recognized the country’s young and talented demographic profile, saying, “[The] Philippines stands to benefit because of its large pool of tech talent––the reason some of the world’s biggest BPOs go to the Philippines…I was really intrigued to find that some of the largest pool of scholars, which is the young kids who can actually code and play games, are all in the Philippines. So this capacity to be able to leverage a shift in technology, the Philippines can play to that very well.”

Budget Secretary Amenah F. Pangandaman presented the priority expenditures supporting the Philippine Development Plan (PDP) 2023-2028.

According to her, 38.1 percent of the national budget amounting to PHP5.27 trillion, has been allotted for the Social Services sector in order to revitalize Education (PHP896.08 billion), promote quality Healthcare (PHP320.89 billion), and strengthen Social Protection (PHP616.79 billion).

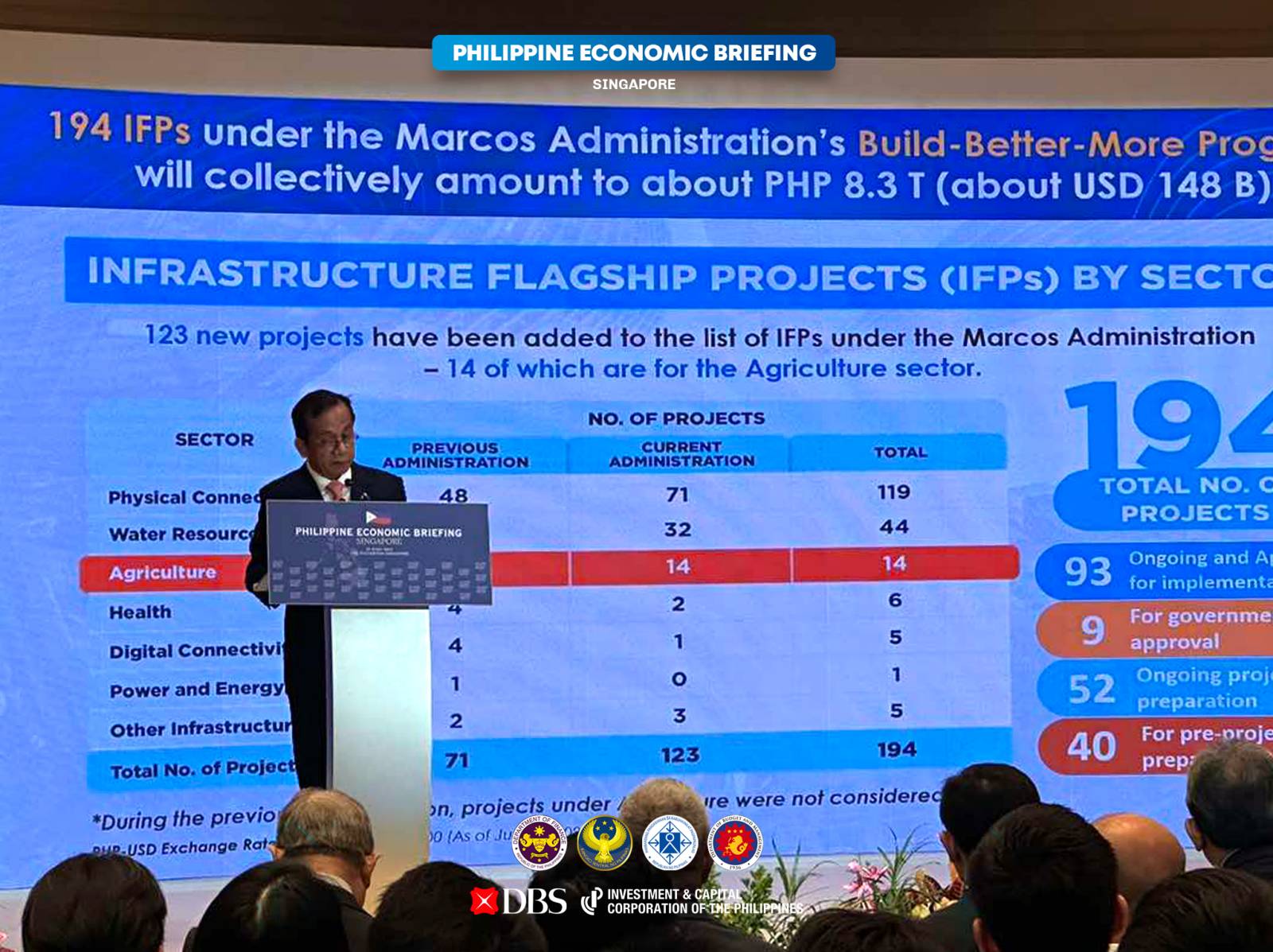

On the other hand, National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan briefed investors on the Philippines’ 194 recently approved infrastructure flagship projects (IFPs) under the PBBM administration’s Build, Better, More Program, amounting to about PHP8.3 trillion.

There are 220 awarded public-private partnership (PPP) projects as of April 30, 2023 with a total estimated project cost of PHP2,580 billion. Meanwhile, 98 projects consisting of projects in transport, road, property development, health, water and sanitation, ICT, solid waste management, energy, and tourism are in the pipeline.

Victor Andres C. Manhit, Founder and Managing Director of Stratbase Group and President of the Stratbase ADR Institute, commented, “You see challenges of jobs, income, but still, opportunities through investments are happening through different interventions by the government and even interests coming from the private sector.”

After the presentations, the economic team participated in a discussion and Q&A session moderated by BSP Managing Director Antonio Joselito G. Lambino II and DBM Undersecretary Margaux Marie V. Salcedo.

During the session, Secretary Diokno answered a question on the MIF’s objectives and strategic priorities, saying that the Fund will be used to finance some of the approved IFPs.

“We have identified another source of funding for these very important infrastructure projects that will make a difference in the landscape of the Philippine economy. It [also] has commercial purposes because the fund has to earn money. So you have short-term, long-term investment, and we propose to create several sub-funds––infrastructure fund, maybe a green fund, and so on,” he said.

He further explained that once the Philippines is elevated to upper middle-income status, it will not be entitled to the same official development assistance funding.

In his closing remarks, Chairman Emeritus of the ICCP Guillermo D. Luchangco said, “This is really, in my opinion, a good time to further your interests in your specific areas in our country. Let me emphasize that we view the complementarity between the Philippines and Singapore as exceptional.”

ICCP is a leading independent licensed investment house in the Philippines offering investment banking services, from raising capital in the debt and equity markets to financial advisory services, including mergers & acquisitions.

###